Every claim that requires manual intervention costs a health plan approximately $20 to process. An auto-adjudicated claim? Just $0.90.

The $20 vs $0.90 Problem: When speed costs 22x more than it should

That's a 22-fold difference, and it compounds quickly. For a health plan processing 10 million claims annually, with 15-20% requiring manual review (the industry norm), we estimate $30-40 million in unnecessary processing costs.

Then there are hidden costs: provider frustration from payment delays, member dissatisfaction, appeals administration, and the opportunity cost of clinical staff spending hours on claims review instead of care management.

Despite decades of investment in claims editing systems, only one-third of payer adjudication processes are fully automated as of 2024. Industry benchmarks show 80-85% auto-adjudication rates as typical, with best-practice organizations reaching 85-90%. That means even the best performers are manually handling 10-15% of claims, resulting in millions of unnecessary manual interventions across the industry.

The Resource Utilization Reality

Pre-payment adjudication demands significant staffing:

- Claims examiners: 10-20 per 100,000 members, processing 80-250 claims daily; suspended claims take 15-30 minutes each.

- Clinical review nurses: 2-5 per 100,000 members, spend 20-30 minutes reviewing flagged claims for medical necessity.

- Certified coders & medical policy specialists: Validate complex coding and maintain claim policies.

- SIU analysts: Investigate potential fraud before payment.

- Medical directors: Oversee complex or high-cost cases.

Using this utilization math, a regional plan with 500,000 members generally needs: 50-100 claims examiners, 0-25 clinical review nurses, 15-25 certified coders, 5-10 SIU analysts, and 2-3 medical directors for pre-payment review.

Manual intervention in 15-20% of claims drives most staffing costs. Each 1% rise in auto-adjudication saves ~5 FTEs and $240,000 in interest, excluding labor savings.

The Current Workflow: Where Millions Get Lost

Pre-payment adjudication follows a three-stage workflow designed over decades to catch errors before money leaves the door:

Stage 1: Claim Intake & Validation (seconds to minutes)

Claims arrive electronically via EDI 837 transactions or through provider portals. Paper claims undergo OCR scanning with 90-99% data extraction accuracy. Initial validation occurs within seconds:

- Eligibility verification confirms active coverage

- Member demographics match enrollment records

- Duplicate detection algorithms screen for previously processed claims

- Format compliance and code validity checks (HIPAA compliance edits)

Clearinghouse platforms perform front-end edits. EDI gateways automatically validate codes, member IDs, and provider credentials. Errors trigger rejections back to providers for correction.

This stage works reasonably well when data quality is high. The problem emerges in the next stage.

Stage 2: Automated Claim Edits & Adjudication Engine (seconds for clean claims, minutes to hours for exceptions)

This is where the complexity explodes. The claim passes through a seven-step review logic:

- CPT/ICD-10/HCPCS code validation against current code sets

- NCCI (National Correct Coding Initiative) edit application to prevent unbundling

- Medical necessity screening against coverage policies

- Benefit verification including deductibles, copays, and coverage limits

- Provider validation ensuring credentials and network status

- Pricing application matching negotiated contract rates

- Coordination of benefits (COB) checking for duplicate coverage

Leading platforms apply massive rule sets:

- Change Healthcare's Lyric: 81 million edits with quarterly NCCI updates

- Optum's ClaimLogic: 119 million edits across government and commercial lines

Claims passing all validations auto-adjudicate in seconds to minutes. But here's where math gets expensive.

15-20% of claims trigger suspends (pends) requiring manual review.

Common culprits include:

- Provider data mismatches

- Missing or incorrect modifiers

- Authorization data not loading from PA systems

- New CPT codes not yet configured in fee schedules

- Medical necessity flags for services lacking prior authorization

- High-dollar thresholds ($10K-$25K professional, $50K+ institutional)

- Outlier procedures for the provider or diagnosis

- COB errors (representing 80% of overpaid claim findings)

Stage 3: Pre-Payment Review & Payment Decision (15-30 minutes per suspended claim)

Pended claims route to claims examiners who determine whether the issue requires:

- Simple data correction (can be resolved in system)

- Clinical input (routes to RN reviewer)

- Fraud investigation (routes to SIU analyst)

- Medical director review (complex or high-dollar cases)

- Claims examiners review flagged cases, accessing medical records via imaging systems or attachment portals, and use their judgment to override edits, adjust pricing, or deny claims with specific codes.

- RN reviewers retrospectively apply InterQual/MCG criteria, the same used for prior authorization, to determine if services should have been approved.

- Medical directors handle peer-level reviews of complex, experimental, or high-value cases.

- Workflow tools route cases electronically. AI fraud detection scores claims for risk and flags them for SIU review.

Manual processing lengthens payment cycles from minutes to 1-2 weeks, causing provider dissatisfaction and higher administrative workload.

Current AI: Helpful, But Not Transformative

Today's claims adjudication AI operates primarily as a recommendation layer:

- Natural language processing extracts information from medical records and itemized bills

- Machine learning models flag anomalies based on historical patterns

- AI fraud detection scores claims for the likelihood of improper billing

- Pattern analytics identify sophisticated schemes escaping claim-by-claim analysis

The Neuro-Symbolic Difference: Deterministic Intelligence

Nēdl Labs' neuro-symbolic AI architecture addresses the fundamental limitation of current claims adjudication AI: the inability to apply complex rule logic deterministically while maintaining explainability.

Pre-payment adjudication requires:

- Understanding unstructured data (operative notes, medical records, billing details)

- Applying deterministic rule logic (NCCI edits, coding guidelines, benefit rules)

- Reasoning about complex relationships (code families, bundling rules, modifier hierarchies)

- Providing auditable explanations (why was this claim paid/denied/adjusted?)

Nēdl Pulse's compound AI architecture:

Neural networks parse unstructured claims data, medical records, and clinical documentation with human-level comprehension. They extract relevant clinical facts, identify coding patterns, and flag potential inconsistencies.

Symbolic reasoning engines apply NCCI edits, bundling rules, medical necessity criteria, and coverage policies as executable logic rather than recommendations requiring human validation. The system reasons through modifier hierarchies, code family relationships, and benefit determination rules deterministically.

Knowledge graphs maintain complex relationships between:

- CPT codes, ICD-10 codes, and HCPCS codes

- NCCI procedure-to-procedure edits and medically unlikely edits

- Coverage policies (NCDs, LCDs, plan-specific rules)

- Provider contracts and fee schedules

- Benefit designs and coordination of benefits rules

- Historical claim patterns and clinical evidence

This architecture doesn't just speed up information extraction; it automates the cognitive reasoning that currently requires human judgment.

The Accelerated Workflow with Nēdl Pulse

Here's how pre-payment adjudication transforms when neuro-symbolic AI handles both data understanding and rule application:

Stage 1: Intelligent Intake & Enrichment (seconds)

When a claim arrives, the knowledge graph can quickly return:

- Clinical documentation and itemized charges

- Provider credentials and network status

- Member eligibility and benefit details

- Historical utilization for this member and provider

Simultaneously, retrieves:

- Applicable NCCI edits for the procedure codes

- Relevant coverage policies (NCD/LCD/plan-specific)

- Provider contract terms and fee schedules

- COB information and other payer details

- Historical approval patterns for similar claims

Time savings: 40-60% reduction in intake processing time through parallel data enrichment and validation.

Stage 2: Symbolic Reasoning Adjudication (seconds to 2 minutes)

This is where neuro-symbolic AI demonstrates transformative capability. Instead of applying rules such as pass/fail gates that generate pends, the symbolic reasoning engine intelligently adjudicates:

For routine claims (65-70% currently auto-adjudicated, increasing to 88-92%):

- Validates codes against current code sets with context awareness

- Applies NCCI edits with understanding of appropriate modifier use

- Checks medical necessity against coverage policies

- Verifies benefits and calculates member responsibility

- Validates provider credentials and applies contract pricing

- Checks COB and prevents duplicate payments

Decision time: < 5 seconds with complete audit trail

For claims with apparent issues (15-20% currently pended, reducing to 6-10%):

The system doesn't just flag problems—it reasons through them:

Scenario: Missing modifier on potentially bundled service

- Current system: Pends claim → Claims examiner reviews → Contacts provider or applies judgment → 15-30 minutes

- Nēdl Pulse: Analyzes clinical documentation → Determines if services were distinct → Applies appropriate modifier or bundles correctly → Explains → 30-60 seconds

Scenario: High-dollar claim exceeding threshold

- Current system: Routes to clinical reviewer → RN examines medical records → Applies InterQual criteria → 20-30 minutes

- Nēdl Pulse: Extracts clinical justification from records → Applies medical necessity criteria symbolically → Identifies specific criteria met/not met → Routes to RN only if criteria gaps exist → 2-3 minutes for complex cases

Scenario: Potential COB issue detected

- Current system: Pends claim → Analyst queries other payer databases → Determines payment responsibility → 20-30 minutes

- Nēdl Pulse: Queries relevant databases in parallel → Applies COB logic deterministically → Calculates correct payment responsibility → 10-15 seconds

For fraud/abuse flags (1-3% requiring SIU investigation):

Instead of just scoring claims for risk, the system:

Identifies specific pattern anomalies with clinical context

- Compares against knowledge graph of known fraud schemes

- Provides structured evidence summary for investigators

- Routes only cases with substantive fraud indicators

SIU analyst time: Reduced 50-60% through pre-investigation by AI

Stage 3: Automated Payment Decision & Communication (seconds)

Approved claims pay instantly with:

- Complete explanation of benefits (EOB)

- Audit trail showing which edits were applied

- Policy citations for any adjustments or denials

- Transparent reasoning meets regulatory requirements

Denied or adjusted claims include:

- Specific reason codes with plain-language explanations

- Citation of applicable NCCI edits or coverage policies

- Clinical criteria not met (if medical necessity denial)

- Clear path for appeal or corrected resubmission

No manual EOB generation. No delay waiting for analyst review. Payment cycles return to seconds or minutes instead of days or weeks.

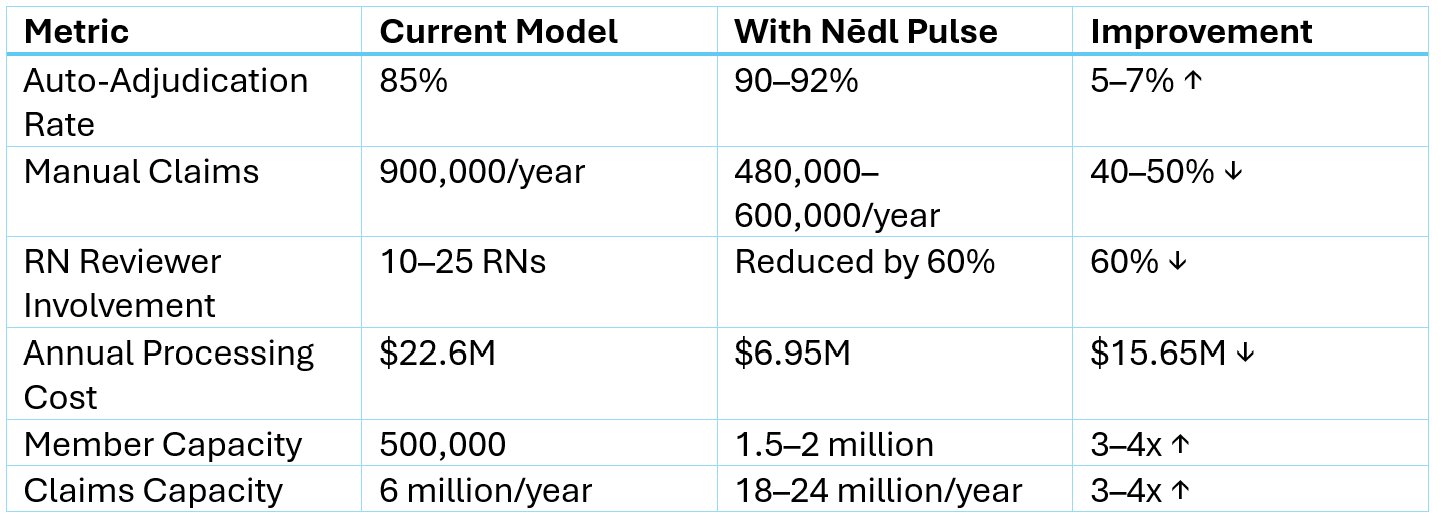

The Economics: From Linear Scaling to Exponential Capacity

The current model scales linearly: double your membership, roughly double your claims processing staff (or your auto-adjudication better improve).

Why Neuro-Symbolic Matters for Claims Adjudication

Claims adjudication is fundamentally a reasoning problem disguised as a data processing problem. You're not just validating fields—you're applying complex, interdependent rules that require understanding:

- Code relationships: CPT 66984 (cataract surgery) can bundle multiple services but requires correct modifiers for bilateral procedures or complications

- Medical necessity logic: An MRI might be medically necessary for one diagnosis but investigational for another

- Temporal reasoning: Global surgical periods prevent separate payment for follow-up visits within 90 days

- Contract complexity: Tiered pricing, bundled payments, value-based arrangements

- Regulatory hierarchies: NCDs override LCDs, which override plan policies

Pure neural networks can't reliably navigate this complexity. They might correctly adjudicate 85-90% of claims by pattern matching, but the 10-15% where they fail are often the most expensive, most complex, most likely to generate appeals.

Rule-based systems handle the logic perfectly but require humans to interpret the unstructured data—medical records, operative notes, itemized bills—and translate it into structured inputs the rules engine can process.

Neuro-symbolic AI solves both sides:

- Neural networks understand the unstructured clinical and billing data

- Symbolic reasoning applies the complex rule logic deterministically

- Knowledge graphs maintain the web of relationships between codes, edits, policies, and contracts

- The combination delivers both accuracy and explainability

The Path Forward: Rethinking Auto-Adjudication

The industry has plateaued at 80-85% auto-adjudication because we've optimized the current architecture as far as it can go. Getting to 90%+ requires a fundamental shift: from AI that helps humans make decisions to AI that makes decisions and explains them to humans.

Nēdl Pulse demonstrates what becomes possible when you architect AI specifically for claims adjudication

- Speed: Payment cycles measured in seconds, not days

- Accuracy: Deterministic rule application eliminates judgment variability

- Explainability: Complete audit trail of why every decision was made

- Scale: Exponential capacity growth without proportional staffing increases

- Provider experience: Fast, accurate payment with transparent explanations

- Compliance: Built-in adherence to NCCI, coding guidelines, and coverage policies

Want to see what 90%+ auto-adjudication looks like at your health plan? Let's discuss how Nēdl Labs' neuro-symbolic AI can transform your claims processing economics.

Share this article

About the author

Founder nēdl Labs | Building Intelligent Healthcare for Affordability & Trust | X-Microsoft, Product & Engineering Leadership | Generative & Responsible AI | Startup Founder Advisor | Published Author

Most Recent

Top Articles

Also See

The Roadmap Dead-End Detector

CPT Governance Is Healthcare's Next Payment Integrity Frontier

Escaping Pilot Purgatory: Why Technical Success is a Vanity Metric

The Great Shift Left: How Neuro-Symbolic AI turns Denial Management into Prevention

What is Payment Integrity in Healthcare?